Helping small businesses navigate their finances.

I will focus on the numbers so you can focus on your business.

Helping small businesses navigate their finances.

I will focus on the numbers so you can focus on your business.

I'm a caring bookkeeper with a focus on providing clients with exceptional accurate service in a timely manner, while supporting the best interests of your business. I provide the following:

- General Ledger Maintenance

- Post Debits and Credits

- Accounts Payable

- Accounts Receivable

- Bank and Credit Card Reconciliation

- Payroll Services – Weekly, Bi-weekly, Semi-Monthly, Monthly

- Government Remittances

Additional Services Provided:

- Custom Chart of Accounts

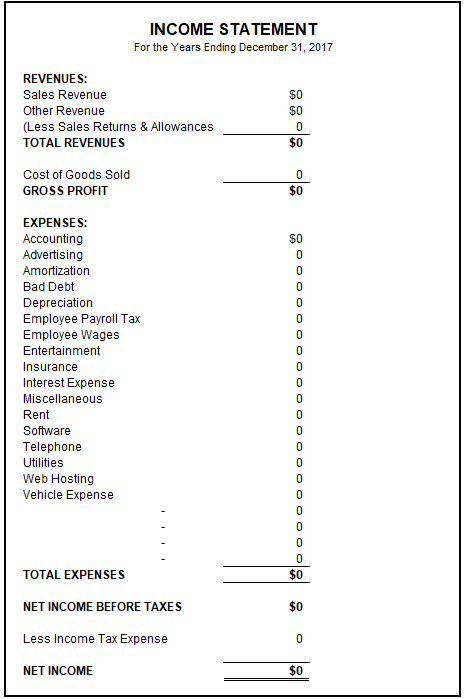

- Monthly Financial Statements (Balance Sheet & Income Statement)

- GST & PST Filings

- Preparation of records for accountant at year end

- Pick up & drop off of paperwork

- Reminders

- Payroll Updates

- File review for irregularities

I'm here to help simplify the bookkeeping process.

I can assist you with bookkeeping services to meet your business and/or personal needs. Whether it is monthly, quarterly or annual bookkeeping.

If you're starting a business, I can set up custom financial statements based on your businesses needs or if you just don’t like what your program offers, I can do a personalized/custom Chart of Accounts based on your requirements.

I can assist in the GST filing requirements for your business as it is a requirement for most businesses to collect and remit GST to the Canadian Revenue Agency on a periodic basis. I will ensure the submission of GST is completed on time and submitted to the proper government authority. I will also calculate and file any PST as is necessary

From Bank and credit card reconciliations to GST and PST submissions, I will ensure your books are accurate and up-to-date. I will deliver accurate monthly financial statements, giving you visibility into your business performance.

As part of the yearend process, I will reconcile your annual payroll remittances and calculate any discrepancies for the year and make any necessary adjustments while preparing T4’s for employees and providing such T4’s to the Canada Revenue Agency.

What is a Bookkeeper?

A Bookkeeper is responsible for recording and maintaining a business’ financial transactions, such as purchases, expenses, sales revenue, invoices, and payments. The bookkeeper will record financial data into general ledgers, which are used to produce the balance sheet and income statement. The bookkeeper is generally responsible for overseeing the first six steps of the Accounting Cycle, while the last two are typically taken care of by an accountant. While there is a general overlap between the two professions, there are a few distinctions that you can read about here.

Give me a call or fill out the form so I can find out about how I can help.